The crossover point: How to know when you’ve achieved financial independence

Today I want to introduce you to the Crossover Point, that magical place where you have enough saved that you can live off your investment returns. To start, let's talk about one of my money heroes, billionaire Warren Buffett.

Buffett wasn't always a billionaire. He started from scratch, just like you and me. Here he is in 1948 — when he had less than $10,000 to his name:

![Warren Buffett was a young dork. Truth be told, he's an old dork too. [Warren Buffett 1948]](https://www.getrichslowly.org/wp-content/uploads/warren-buffett-1948.jpg)

What a dork!

Buffett began making money when he was six years old. He'd buy packs of chewing gum for three cents each, then go door to door selling them for a nickel. (He refused to sell individual sticks; you had to buy an entire pack of Doublemint or nothing.)

“He could hold those pennies, weighty and solid, in his palm,” writes Alice Schroeder in her excellent Buffett biography. “They became the first few snowflakes in a snowball of money to come.”

From chewing gum, Buffett graduated to soda pop. He sold bottles of Coca-Cola to his neighbors in Omaha, and he even peddled his wares to sunbathers while vacationing at Lake Okoboji in Iowa. Buffett sold used golf balls. He hawked peanuts and popcorn at University of Omaha football games.

All the while, he kept score. He deposited his pennies and nickels in the bank and kept track of his savings in a passbook.

At a young age, Buffett began to grasp the extraordinary power of compounding. Again from Schroeder's book: “The way that numbers exploded as they grew at a constant rate over time was how a small sum could turn into a fortune. He could picture the numbers compounding as vividly as the way a snowball grew when he rolled it across the lawn.“

When he was ten years old, Buffett vowed to become a millionaire by age thirty-five. By the time he turned eleven, he'd accumulated $120. He used his cash to buy his first three shares of stock. He had 24 years and $999,880 to go to meet his goal.

Buffett's Snowball of Money

When Buffett left Omaha for college at age 20, he'd saved $9804, some of which was in stocks. He moved to New York to attend Columbia University, where he took finance classes from Benjamin Graham and David Dodd. He continued to invest, both for himself and now for family and friends. He wrote articles about the stock market. (Even back in 1952, he was obsessed with GEICO stock.) He bought his first business, a service station.

Buffett got married and had kids. He earned more money, both from work and investing. All the same, he was reluctant to spend. He was frugal — almost miserly. He didn't like to buy new clothes. He made a deal with a nearby newsstand to purchase outdated magazines at a discount. For a long time, he didn't own a car. (After he did purchase a vehicle, he'd only wash it when it rained.)

Like a money boss, Buffett kept his costs down while boosting his income.

“For Warren, holding on to every penny this way, since he had sold that first pack of chewing gum, was one of the two things that had made him comparatively rich at age twenty-five,” writes Schroeder in The Snowball. The other contributing factor? Buffett was making money at an ever-increasing rate.

The years and decades passed. Buffett continued to invest. His snowball grew exponentially.

- By age 11, Buffett had saved $120.

- By age 21, Buffett had a net worth of $19,738.

- By age 26, Buffett was worth $140,000.

- By age 30 — five years ahead of schedule — Buffett was a millionaire.

- By age 40, Buffett had more than $25,000,000.

- By age 50, Buffett had accumulated over $150,000,000.

- By age 60, Buffett had become a billionaire.

Today, Warren Buffett is worth $84.1 billion. He's the third-richest man in the world. During his 85 years, he's created the greatest wealth snowball the world has ever seen.

And it all started with chewing gum.

I can't promise that you and I will become billionaires. In fact, our chances of doing so are exceedingly slim. But I can promise that if you follow the advice I share at Get Rich Slowly, you will produce a modest wealth snowball of your own. And if all goes well, you'll eventually reach that Crossover Point where you can live off your investments for the rest of your life.

Your Wealth Snowball

You begin rolling your wealth snowball the moment you achieve a positive cash flow — as soon as you're earning more than you spend. Each penny of profit adds to your fortune.

- When you stay late to work overtime, you add do your wealth snowball.

- When you choose to bike instead of drive, you add to your wealth snowball.

- When you decide to downsize your home or work a second job or skip the new iPhone, you add to your wealth snowball.

The bigger your profit margin, the faster the snowball grows.

It's not just earning and spending that affect your wealth. Your investment returns play an important role too. In the short term, your contributions have a greater impact than investment performance, but over the long term the extraordinary power of compounding comes into play.

Assume you make a one-time $5000 contribution to your retirement account at age twenty and manage to earn an 8% return every year. If you never touch the money, your $5000 will grow to $159,602.25 by the time you’re sixty-five years old. But if you wait until you’re forty to make that one-time investment, your $5000 would only grow to $34,242.38 before you retire. Compounding is the reason it's so important to begin investing when you're young!

When you add to your wealth snowball regularly, its growth accelerates.

If you were to invest $5000 each year for forty-five years, for instance, and if you left the money to earn an 8% annual return, your savings would total over $1.93 million. You’d have more than eight times the amount you contributed. This is the power of compounding.

Because you're a money boss, you don't want to wait forty-five years to achieve Financial Independence. You want to reach your Crossover Point in ten or fifteen years, not fifty. With a short investment horizon, there's less time for compounding to do its work. That's why it's so important to save half of your income — or more.

Here's what Mr. Money Mustache calls the shockingly simple math behind early retirement:

- With a 10% profit margin (or saving rate), you'd need to work for 50 years to reach Financial Independence. Your wealth snowball grows — but not quickly.

- With a 20% profit margin, you'd need to work for 37 years to achieve Financial Independence.

- With a 35% profit margin, you'd need to work for 25 years to achieve Financial Independence.

- With a 50% profit margin, you'd only need to work for 17 years to achieve Financial Independence.

- And if you can manage to save 70% of your income, you could achieve Financial Independence in 8-1/2 years!

Pull out your personal mission statement. Look at your goals. Your profit margin directly affects how quickly you’ll achieve these aims. The sooner you grow your wealth snowball, the sooner you can do the things you dream of doing.

The Crossover Point

At some point in the future, your wealth snowball will be so large that it'll last the rest of your life. You’ll never have to work for money again unless you choose to. It’s at this point that you’ll have reached Financial Independence.

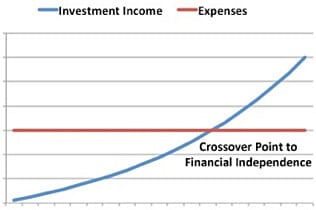

At this crossover point — a term coined by Joe Dominguez and Vicki Robin in Your Money or Your Life — your investment returns provide more money than you spend.

Realistically speaking, it's important to have a margin of safety. (In fact, this is one of Warren Buffett's core beliefs!) To that end, I make the following assumptions when I calculate whether somebody has reached the Crossover Point:

- You'll spend as much in the future as you do now. (About one third of people spend more, one third spend less, and one third spend the same.)

- If you withdraw about 4% from your savings each year, your wealth snowball will maintain its value against inflation. During market downturns, you might need to withdraw as little as 3%. During flush times, you might allow yourself 5%. But around 4% is generally safe.

Based on these assumptions, there's a quick way to check whether or not the Crossover Point is within your reach.

Multiply your current annual expenses by 25. If the result is less than your savings, you've achieved Financial Independence. If the product is greater than your savings, you still have work to do. (If you're conservative and/or have low risk tolerance, multiply your annual expenses by 30. If you’re aggressive and/or willing to take on greater risk, multiply by 20.)

If you'd prefer, you can approach the problem in reverse. Start with your current wealth snowball and see how long it'll last.

To keep things simple, we'll work with net worth (the difference between what you own and what you owe). If you've already calculated your net worth, use that number. Otherwise, you can copy this net worth spreadsheet I created in Google Docs.

Once you have your net worth, multiply it by 4% (or by 0.04). Based on recent history, this is how much you could safely spend each year without draining your savings. (If you want to be conservative, multiply by 3%. If you're feeling bold, multiply by 5%.)

How do these numbers make you feel? Is your wealth snowball bigger than you thought? Or is there work to be done before you'll feel secure? How long until you reach your Crossover Point? Or are you already there?

Photo credit: Snowball by Kamyar Adi. Not sure who took the young Buffett photo.

Note: I'm migrating old Money Boss material to Get Rich Slowly — including the articles that describe the “Money Boss method”. This is the tenth of those articles.

- Part one answered the question, “What is financial independence?”

- Part two looked at why you should run your life like a business.

- Part three explained how to write a personal mission statement.

- Part four explored the importance of saving rate.

- Part five showed why the best way to spend less is to cut back on the big stuff.

- Part six was all about how to earn more money.

- Part seven peeked at opportunity costs and conscious spending.

- Part eight delved into my investment strategy and philosophy.

- Part nine is my favorite. It tells readers how to automatically do the the right thing with money through the power of automation.

Look for the final installment in the “Money Boss method” series later this week.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)