Start where you are

Ah, a brand new year.

It's good to have the sense that we can begin anew, that we can shed some of those habits and behaviors that have been holding us down while adopting new patterns that lead us to become better humans.

I actually enjoyed a fruitful year. I lost 24 pounds. I (mostly) gave up alcohol. I made progress in my fight against depression and anxiety. And, most importantly, I resumed the habit of writing regularly.

This year, I want to build on this momentum. I want to continue these habits while incorporating a few new ones, such as tracking my time, keeping a personal journal, and — once I reach my target weight — exercising regularly once more.

There's one thing that often holds me back when I decide to make changes. It holds others back too. It's the overwhelming feeling that there's just so much to do — and that I've handicapped myself through poor choices in the past. I remember the physical feats I was capable of when doing Crossfit a decade ago, for instance, and I feel a sense of helplessness. I'm nowhere near as fit I was ten years ago. There's no way I can do that stuff today.

But I have to remind myself: It's not a competition. I ought not compare myself to others — or to my past self. My sole goal should be a better person tomorrow than I am today.

To do this, I must accept who I am, where I am. It sure would be nice if I were to start a fitness program in better shape than I currently am, but that's only a dream. If I want to change, I have to accept reality. I need to start where I am.

And if you want to change — if you want to master your money, your health, your relationships, your career — you too must start where you are.

How to Start Where You Are

Clearly, this is easier said than done. It's one thing for me to sit at my desk and type out pithy advice; it's another to actually deal with the situation day-to-day in real life.

Clearly, this is easier said than done. It's one thing for me to sit at my desk and type out pithy advice; it's another to actually deal with the situation day-to-day in real life.

But here's the thing: In order to get where I am, I had to start where I was. In order for other Get Rich Slowly readers to get where they are today, they had to start where they were.

When I say “start where you are”, I mean that you should accept that who you are and what you have today is, essentially, your starting hand. Don't beat yourself up for past mistakes. Don't blame others for getting you into this situation. These are the cards you've been dealt (even if you've dealt them to yourself), and it's now up to you to play them as best you can.

How do you do this?

- First and foremost, take care of yourself. Pause. Breathe. Prioritize your physical and mental health, even if that means spending a bit of time and money. Exercise. Eat right. If you need the help of a therapist, see a therapist. Money spent on self-care is never wasted.

- Next, take stock of your situation. Figure out exactly where you are starting from. Set aside a Saturday morning to perform a “financial inventory”. Ideally, you'd take the time to begin tracking your money with a program like Quicken or YNAB or Personal Capital. At the very least, calculate your net worth and list all of your debts, bills, assets, and income. You need a snapshot of your current financial situation so you know what you're working with.

- Figure out where you want to go. It's great to decide that you want to change, that you want to improve your financial life, for instance. But you'll have greater success if your reason for change is specific, not nebulous. Craft a personal mission statement, and maybe use this to set up a series of smart goals to act as waypoints along the road to your destination.

- If needed, restructure your life. We all suffer from “financial drift”. We become complacent and lose sight of our larger goals from time to time. When you press the reset button, when you start your financial journey, it's the perfect time to make changes, large and small. Analyze all of your spending. Cut the crap you do not need. Consider changing jobs. Ask yourself if it might make sense to move to a cheaper home — or to a cheaper city or state.

- Meanwhile, don't compare yourself to others — not even in the abstract. On an individual level, comparing yourself to your friends and family is a bad idea because you're pitting your internal worst against their external best. Of course this'll make you feel like crap! Besides, it doesn't matter where anybody else is; what matters is where you are relative to where you want to be. It's also a bad idea to compare yourself to statistical norms. Sure, stats can be fun to look at — and I share them all the time here at GRS — but stats are soul-less, lifeless abstract numbers. Statistics don't have cancer. Statistics don't get divorces. Statistics don't struggle with faulty financial blueprints. When you start where you are, worry about your own self — not anybody else.

- Keep things simple. I know first-hand just how tempting it can be to over-complicate things when you want to make a change. I'm a master at this. But the thing is, when you make things too complex, you're less likely to follow through on them. If your fitness program is “I'm going to walk around the block each day”, you'll have a better shot at success than if you decide “I'll bike for all of my errands”. One is simple and the other is not. This advice is especially true with money. Keep things simple at the start; you can always add complexity later.

- Seek support. One of the best things you can do when starting out is find support for the journey ahead. This support can take many forms. You might find a mentor, for instance, somebody who's been down the same path before you. Pick their brain. Find out what worked for them and what didn't. You might put together a “personal board of directors”, trusted experts who can give you solid financial advice. Most of all, look for other people in a similar position to you. Band together so that you can start your journeys together.

I'd also add that when you're making changes, you shouldn't expect to get things right immediately. There's a lot of trial and error. You'll make mistakes. You'll try certain methods that don't quite work, then switch to others. That's okay. Don't get trapped by the need to make a perfect choice when starting out. It's enough to make a good choice in the beginning. There'll be time for perfection later.

There's a lot more to getting out of debt, managing your money, and saving for retirement, obviously. That's what the rest of Get Rich Slowly is all about! But these are the essential steps to getting started. You don't start where your friends or co-workers started. You don't start where you wish you were. You start where you are.

Do More of What Works

To some, this advice will sound stupid. To me, it's a revelation. So simple! So obvious! So smart!

I've read similar advice before, of course. Tim Ferriss, for instance, has talked about the importance of playing to your strengths rather than working on your weaknesses. When you do more of what you're good at, you naturally do less of what you're bad at. You don't have to deliberately avoid your trouble spots because the good crowds out the bad.

Take me, for example.

I like to write. I think I'm good at it. I also like to play videogames. Writing is productive but gaming is not. Some game play is fine; too much is a vice. Rather than try to play fewer games, which seems like deprivation, Ferriss would say that I should instead try to write more, which seems like abundance. If I spend more time writing, as a side effect I will have less time to play games. By honing a strength, I'll be avoiding a weakness.

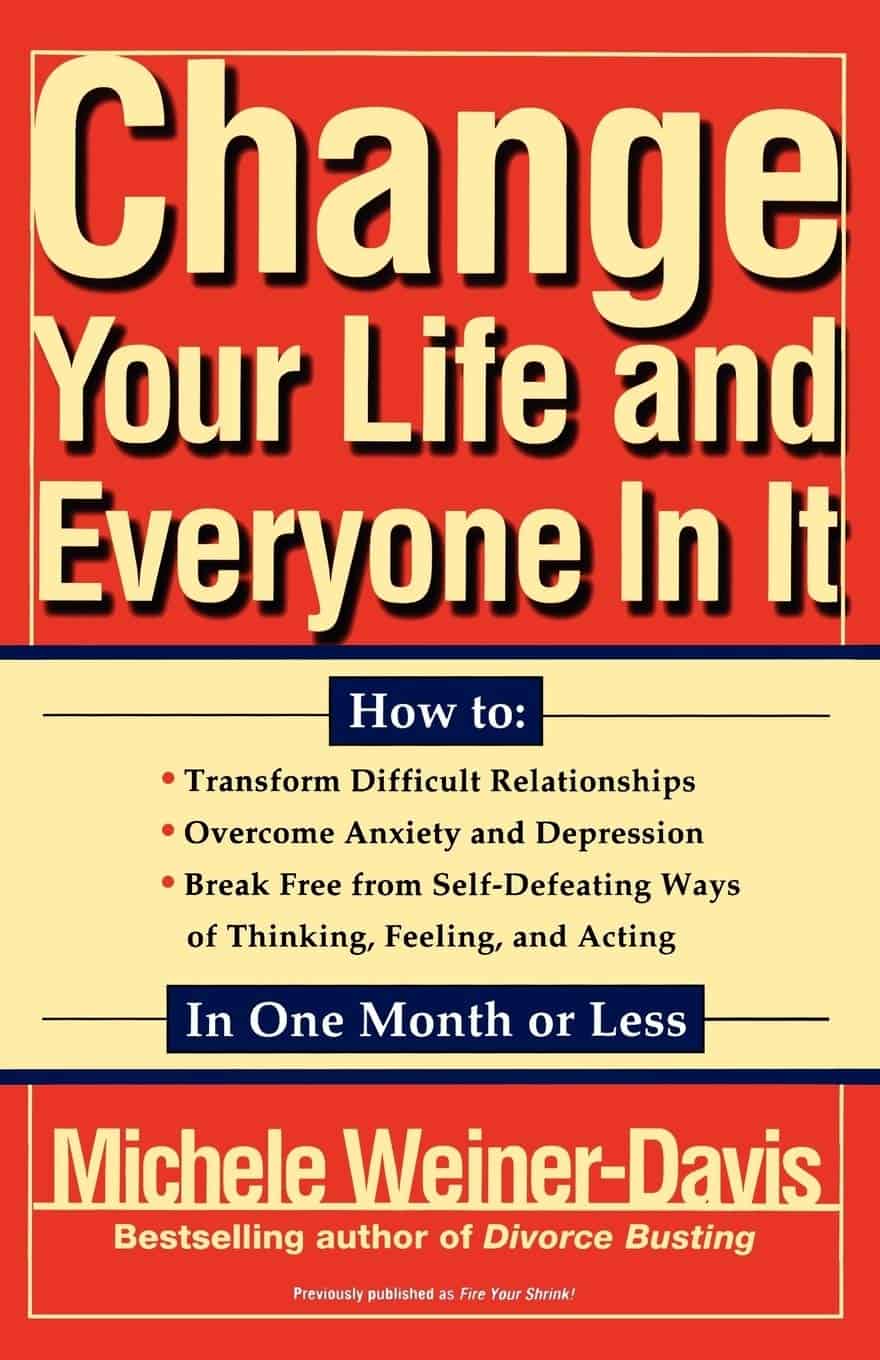

Or, as Weiner-Davis puts it, I'll be doing more of what works and less of what doesn't.

Doing more of what works and less of what doesn't is an essential part of starting where you are. It's tacit acceptance that, like everyone, you're imperfect. You're good at some things but suck at others.

Where I Started

I was in debt for seventeen years before I began my own quest for financial freedom. For many of those seventeen years, I was grasping at straws, trying to find quick fixes to fundamental problems. When I looked at my friends — at my wife, even — I felt ashamed that they were financially successful and I was not.

I wasn't able to turn things around until I surrendered to the idea that I had to start where I was. I couldn't magically will myself into smart financial habits. No amount of wishing was going to give me the same amount of savings that my wife had or the fancy house that my best friend had. It didn't matter where anyone else was on their financial journey. I had to approach my money with what Zen Buddhists call a “beginner's mind”.

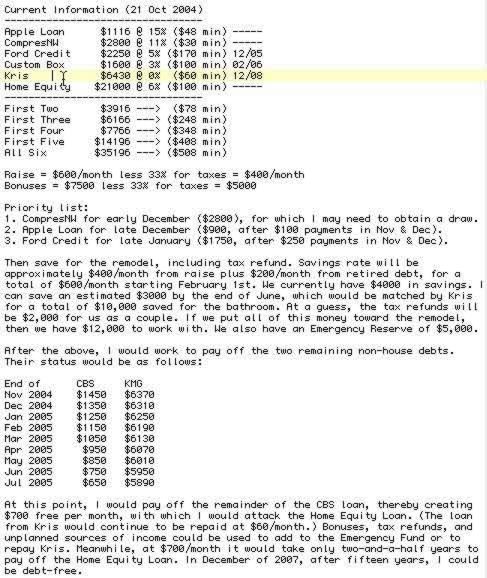

So, in October 2004, I sat down one night to take stock of my situation. I put all of my financial information into Quicken. I entered my bills, my debts, and my income. For the past thirteen years, I've used Quicken (on and off) to keep tabs on where I am.

Next, I figured out where I wanted to go. I drew up this “spending plan” as a roadmap to my desired destination:

Gradually, I restructured my life to be more aligned with my mission. I made major cuts to my spending, which included giving up things I had previously valued such as computer games and comic books. I boosted my income by taking side gigs — and starting this blog.

I stopped comparing myself to my friends. I realized it didn't matter what they had achieved. (I also realized that, in some cases, what appeared to be financial success was built on a house of cards. Some of my friends were just as poor with money as I was. They fueled their fancy lifestyles with debt!)

And, most importantly, sought support. I found people who actually were good with money and asked them for advice. I read books. I participated in online communities. I started Get Rich Slowly, which turned into a massive support group for myself and many others.

The Final Word

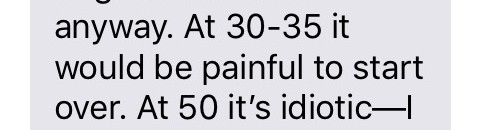

My girlfriend Kim has been fretting that at age 48 she doesn't have enough saved for retirement. She hangs out with me and at early retirement gatherings and comes away feeling inadequate, like she doesn't measure up to the rest of us.

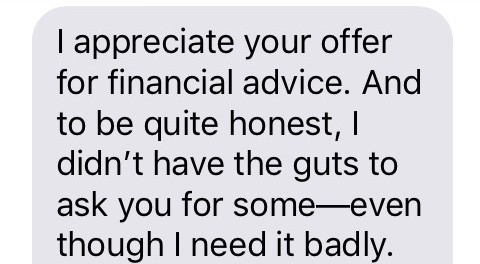

Or there's my friend Joel who desperately wants financial advice — but is afraid to ask for it. He's embarrassed by his past decisions and his present circumstances. He's afraid to look foolish.

Here's my message to people like Kim and Joel: Start where you are. Don't panic. All is not lost. You're not too late. This isn't a contest. Don't fret about your past, and don't worry about how others are doing. Start where you are. Use what you have. Do what you can.

If you're meticulous and methodical, it doesn't matter when or where you start. It's still possible to get rich slowly. I'm here to help — and so are other GRS readers. Join us.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)

There are 1 comment to "Start where you are".

I’m 23 and I’m diving head first into being financially stable on my own. I want nothing more than have a stable safe life. Being raised in the foster system I never had anyone around me to teach the importance of money and what kind of relationship I should have with my money. As soon as I turned 15 I got my first job at Subway. Every pay day id spend my money on things I always missed out on having growing up. Things like day trips to the local beach, a DS and all the popular games that come with it. When I turned 18 I made the biggest decision of my life which was moving states away from Iowa to South Carolina and ever since then I’ve been alone learning from my mistakes. Being here on my own i have a lot of pride and I’m always too scared to ask for help, like Joel. I just want to say thank you for the amazing advice. The more I read your blogs and watch your videos about mental health the more I feel that my mentality and I feel more awake. Start where you are has been the beginning of life changing thoughts. So thank you.