The pros and cons of Personal Capital

If you've read money blogs over the past five years, you've heard about Personal Capital. Personal Capital is a free money-tracking tool with a beautiful interface and — gasp — no advertising. (One of my big complains about Mint is that it shoves ads in your face.)

Many of my friends and colleagues promote the hell out of Personal Capital because the company pays good money when people sign up. (And yes, links to Personal Capital in this review absolutely put money in my pocket. But any Personal Capital link you see anywhere on the web puts money in somebody's pocket.)

I sometimes wonder, though, if any of my pals actually uses Personal Capital, you know? All of their reviews are glowing. While I like Personal Capital, I've been frustrated by the app in the past. Even today, I find that it's not as useful as I'd like.

What are my issues with Personal Capital?

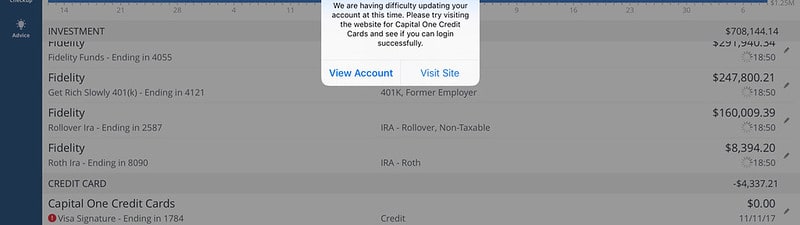

- For a long time, I was frustrated trying to get Personal Capital to connect to my accounts. It still won't connect to my credit union, but that's fine. I can enter my balance manually. It was frustrating, though, that for years I couldn't get Personal Capital to connect to my Fidelity investment accounts. They work now…but I'm always worried that they won't. The app still won't connect to my Capital One credit card — and hasn't for over a year, which I find mind-blowing.

- Personal Capital, as an investment app, isn't robust enough to replace something like Quicken or You Need a Budget. The latter tools allow you to track and manage your money on a transaction by transaction level. Okay, maybe you can track your transactions, but you can't do anything meaningful with them, the same way you could with Quicken or YNAB.

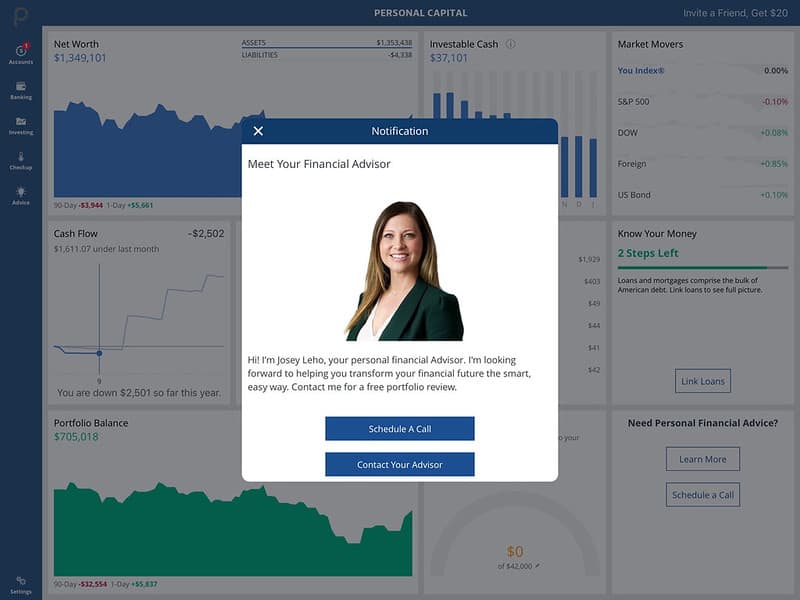

- The phone calls! My god, the phone calls! Here's a not-so-secret secret: The Personal Capital app — while beautiful and useful — is actually bait. It's a lure. Its aim is to attract high net-worth users to connect their accounts. When they do, Personal Capital (the company) begins a phone campaign in an attempt to recruit the users as clients. Personal Capital isn't actually an app company; it's a wealth-management company. They want people with lots of money to sign up. (I can't comment on whether this is a good deal or not. I don't want a financial advisor. I ignore all of the calls from Personal Capital.)

- Personal Capital has pretty reports, but there aren't enough of them. My copy of Quicken 2007 — ugly as it is — has 23 different reports and 10 different graphs. (Plus, you can customize many more.) Personal Capital has maybe…nine ways to look at your money? (I can't tell for sure.)

- The security is over the top. I suppose I should be happy about this, but I'm not. It feels like I'm constantly having to verify my identity via email or text message. Some of my other accounts make me do this occasionally, but it feels like Personal Capital does this multiple times per week. That's crazy!

Now, these complaints aside, here's a confession: I've been using the Personal Capital app for 5+ years. For real. I can't remember when I started, but I do remember being cranky because a Personal Capital rep didn't know who I was at Fincon in St. Louis. “I use your app,” I told him. “And I have a big blog.” (I wince now at the thought of my arrogance.)

Despite the drawbacks, there must be something to it. Right? Today — using my current financial situation — let's look at the pros and cons of Personal Capital.

Quicken 2007 vs. Personal Capital

As regular readers know, I'm an old fogey. My money management tool of choice is an antiquated copy of Quicken for Mac 2007. This tool is so important to me, in fact, that I'm currently refusing to update my system software to the latest version (Mac OS Mojave) because I'm afraid it'll break Quicken. (Other user experiences are mixed.) How important is Quicken 2007 to me? No joke: I would buy a used Mac laptop just to run that software.

As much as I love Quicken, it has its drawbacks. One of those is that it's a pre-mobile app. Quicken 2007 is almost as old as this blog. It came out roughly one year before the first iPhone. (Get Rich Slowly launched on 15 April 2006. I can't find a release date for Quicken 2007, but it was available by at least 30 August 2006. The iPhone launched on 29 June 2007.) If I want to interact with Quicken, I have to sit down at my desktop computer.

Because I'm a nerd, I'm attached to my mobile devices. I have an iPad. And an iPhone. And an Apple Watch. (Why isn't it an iWatch? I don't know. Apple doesn't give a fig about consistency.) I want to be able to track my money from my mobile devices.

Trust me: I've tried tons of other mobile apps. I don't really like any of them. I do, however, like Personal Capital…warts and all. I would never ever use it as my only money management tool, but as one piece of a bigger package, it'a actually kind of awesome.

Personal Capital is the only mobile money management app that I use. There are others out there, sure, but for my needs, Personal Capital fills a niche…and fills it well.

Personal Capital as Daily Money Tracker

I use Personal Capital as a daily tracker. Quicken 2007 is my actual go-to tool for entering and analyzing my data, but Personal Capital is what I've used for the past five years to check on my accounts to make sure everything is okay.

Believe it or not, Personal Capital has saved my bacon several times. What? My credit card payment is due today? Whoops! I'd better go pay it. Wait! What's this strange charge on my account? That's not me. Let me call my bank. Whoa! I forgot to pay my garbage bill. I'd better handle that when I get home.

Because Personal Capital connects to (most of) my accounts, I'm able to look at everything from a unified dashboard. I don't have to log in to each credit card and bank account to verify everything. I can do it from one place. (Okay, not my credit union. I still have to go check that separately.)

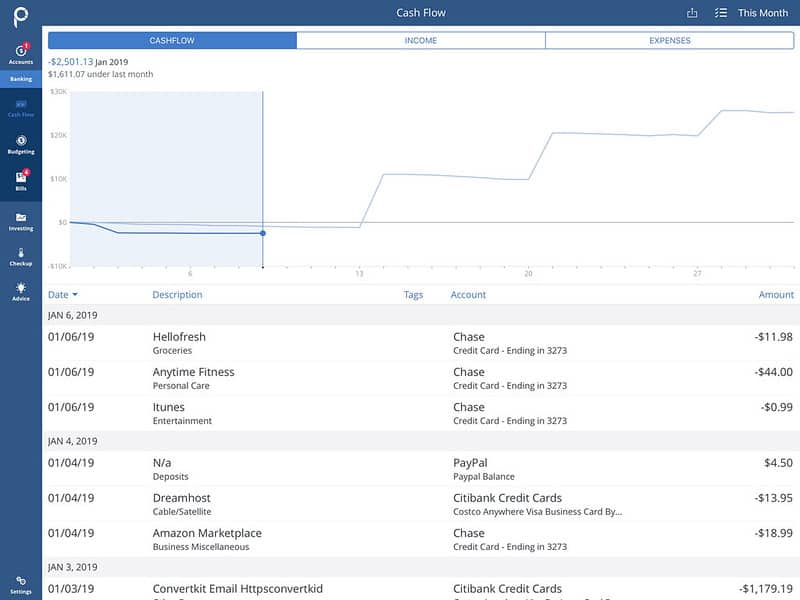

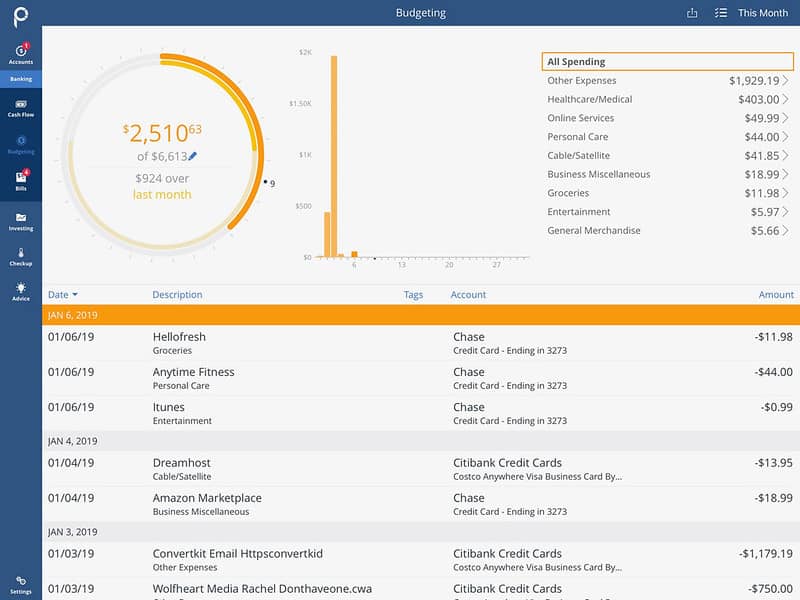

Here, for instance, is a look at my recent transactions. (I have no idea what the graph is tracking. I'm not sure I care.)

When I shared my financial situation recently, a few readers wondered why I don't count my business finances when tracking my entire money picture. Well, in Personal Capital I do. Because I can connect the app to both personal and business accounts, I can get an idea of the Big Picture. Here you can see that most of my expenses for January so far have been blog related.

I'll admit, it's very nice to have a single app where I can view all of my recent transactions, both personal and business. Although I only take action on this info maybe twice per year, it sets my mind at ease. It takes thirty seconds of my time each day, but that's thirty seconds I'm happy to spend.

Personal Capital as Investment Tracker

Honestly, though, Personal Capital isn't meant to be a daily money-management tool. For that, I'd use something like You Need a Budget. Personal Capital is specifically designed to monitor your investments. Because of this, the Personal Capital app has a variety of tools to help investors.

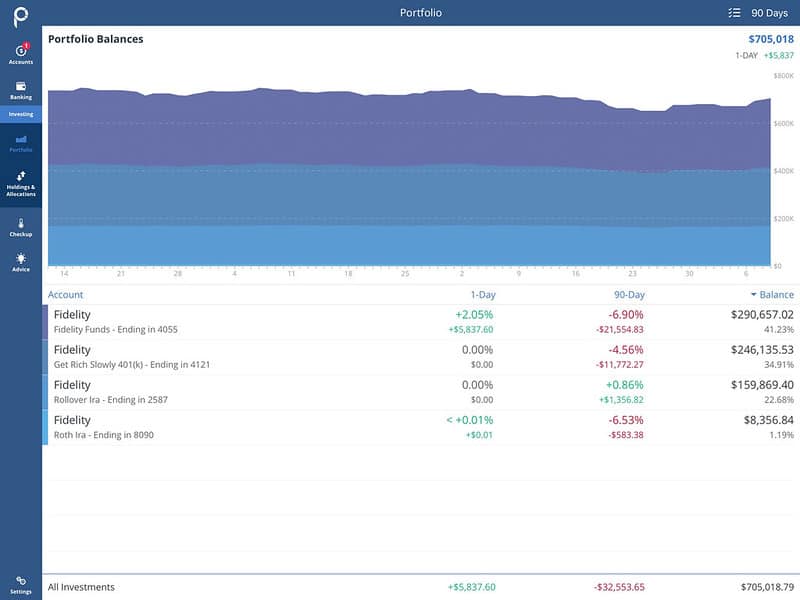

First up, there's the plain ol' portfolio view:

Nothing special here, right? You get a list of your investments and a graph of their performance over the past 90 days. Nothing special, but still easier for me than logging into the Fidelity website (or app).

(As a passive investor, though, I don't actually look at investment performance that often. I might check it once per week…but a couple of times per month is more likely.)

You can also get a breakdown of your asset allocation:

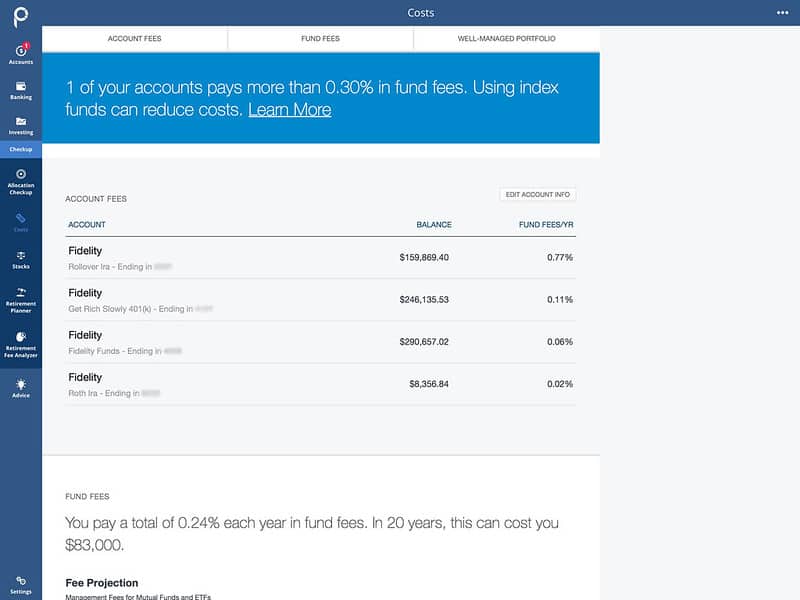

The Personal Capital app also offers something interesting — something I think Vanguard and Fidelity should offer. They have a tool that analyzes the fees on your investment accounts. As you probably know, fees are one of the top drags on the average investor's performance. Too many suckers pay 1% or 2% per year (or more!) in mutual fund costs. Index funds have risen to prominence because they promise management fees of 0.20% or 0.10% (or lower).

Personal Capital makes it clear just how much you're paying in fees.

In my case, I'm doing fairly well except in my rollover IRA. But I'm okay with that. That rollover IRA is 100% invested in a real-estate investment trust (or REIT), and those carry higher expense ratios. (True story: That REIT is actually my highest performing investment over the past decade!)

Personal Capital's Retirement Calculator

All of these other features are great, but there's one main reason I continue to use Personal Capital: its retirement calculator.

As I mentioned the other day, I hate most retirement calculators. They're overly simplistic. Their assumptions are bogus. They're designed to get users to save more than they need.

The Personal Capital retirement calculator isn't the best tool on the market — we'll look at two better tools during the next week — but it's pretty damn good for something that's free and built into an otherwise useful app.

This section is going to be the biggest part of this review, and it's going to contain plenty of screenshots. You've been warned.

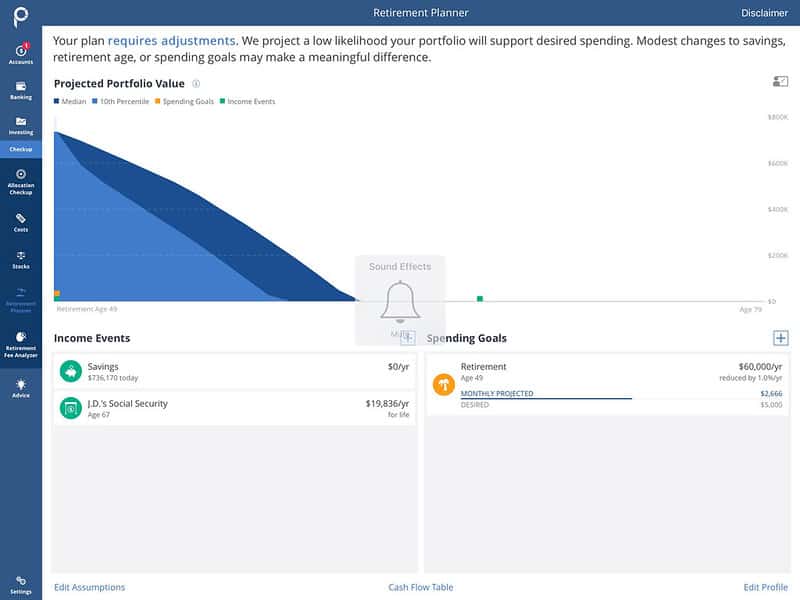

First up, here's a look at my own personal financial situation as of this morning. (Sorry for the “mute” notification in the middle of the screenshot. My bad. Not sure why I was muting my iPad, but I can't fix it now.)

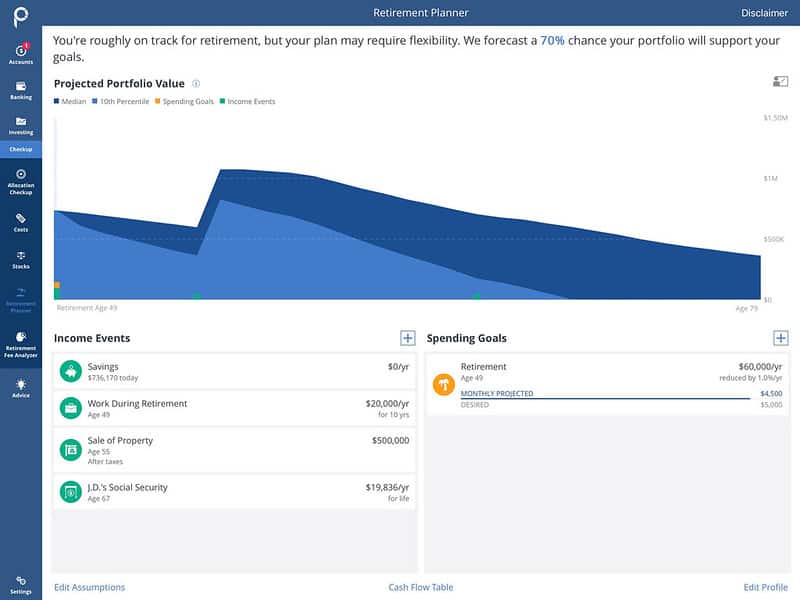

Based on my current situation — $736,170 in liquid investments and roughly $60,000 of annual expenses — Personal Capital says I'll run out of money at 62. This doesn't differ much from other retirement calculators I've looked at.

But here is where Personal Capital gets fun (and the reason I'm obsessed with it). Do you see those + signs across from Investment Events and Spending Goals? If you click on those, you can add new events. (And if you click on existing events, you can modify those.) This means you can tweak your parameters over and over and over again.

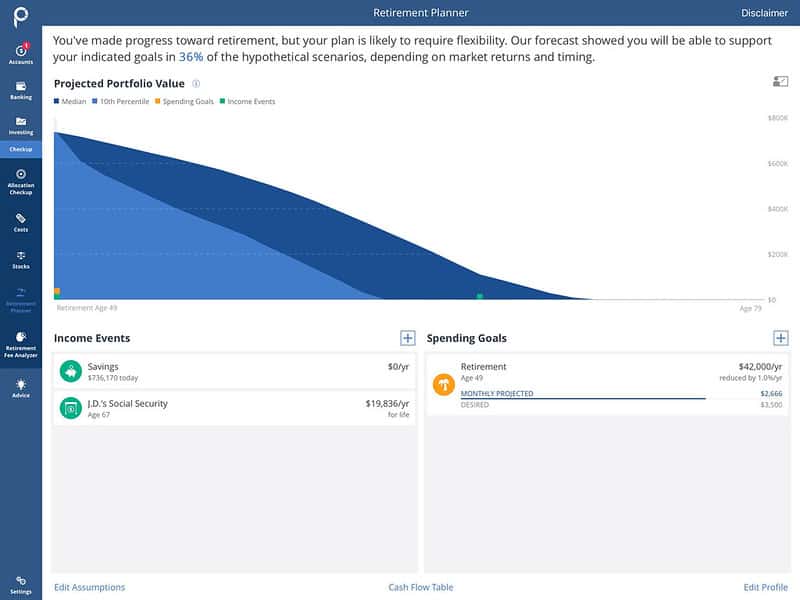

What if, for instance, I decreased my spending from $60,000 per year to $42,000 per year? (This is my aim for 2019.)

Well, look at that. If I re-embrace frugality, my money will likely last until I'm 72 instead of 62. Nice!

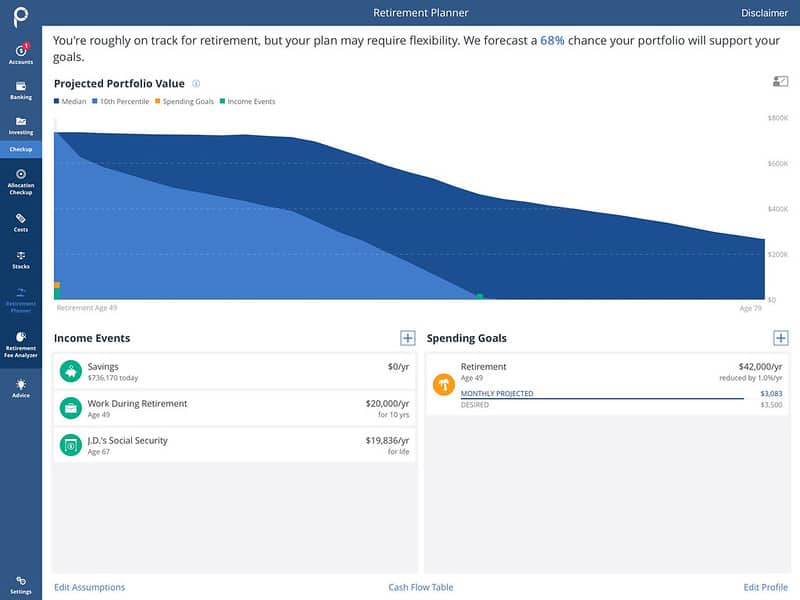

And now that I'm back to work at the box factory, what if I stay there for ten years and earn $20,000 annually?

Holy cats! As you can see, working part-time makes a ginormous difference. If I reduce my spending to $3500 per month while earning $20,000 per year, I'm golden. I shouldn't run out of money before my projected age of demise. (Even in a “worst-case scenario”, my money would last until age 67.)

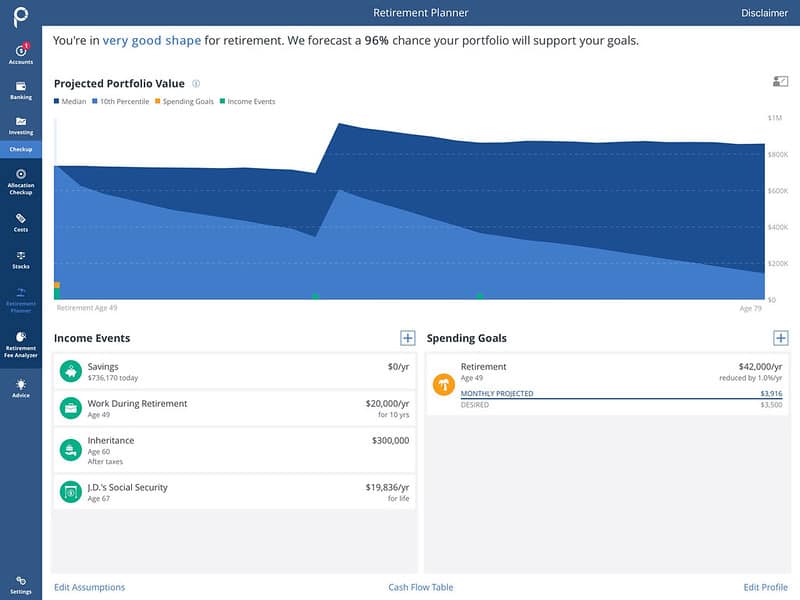

And if I end up with an inheritance? Party time!

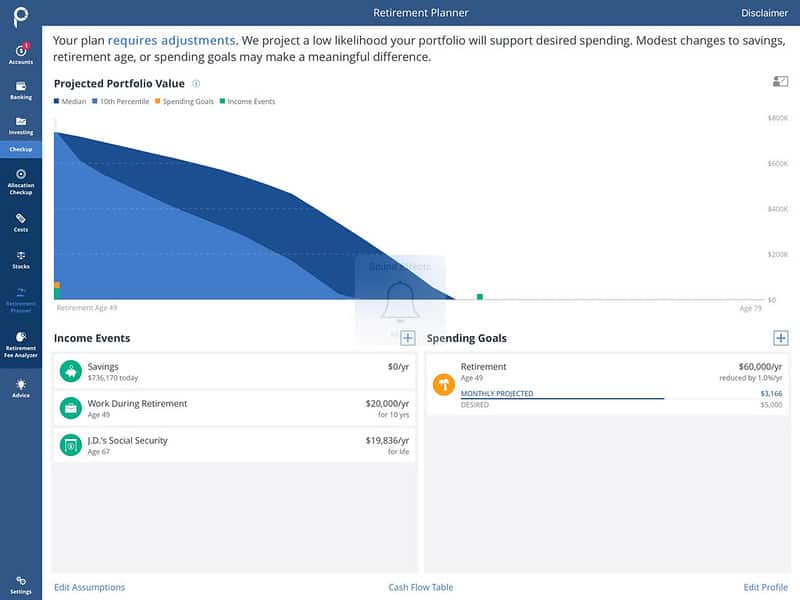

Okay, maybe I'm getting a little too out of control there. Let's dial things back. Let's get rid of the inheritance and bring my spending back to current levels. If I work part-time for ten years, what then?

Hm. Not enough to get me to where I want to go, is it? (Plus, I was muting the sound again. What the heck?) Okay, what if I decide to sell this house at some point in the next ten years. What then?

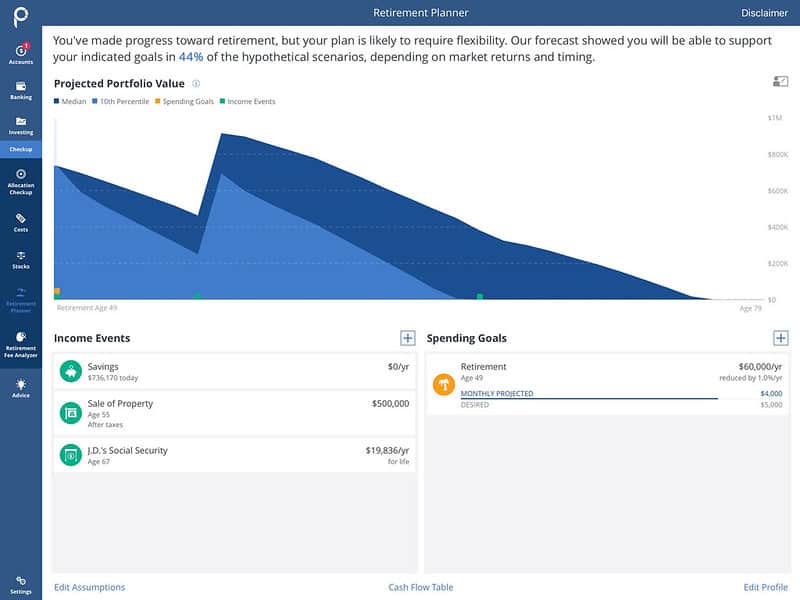

Okay, not bad. That makes me wonder, though, what if I did not decide to go back to work for the family business. What then?

Well, I guess that's not bad, but it's not nearly as good as if I'm bringing in some sort of income.

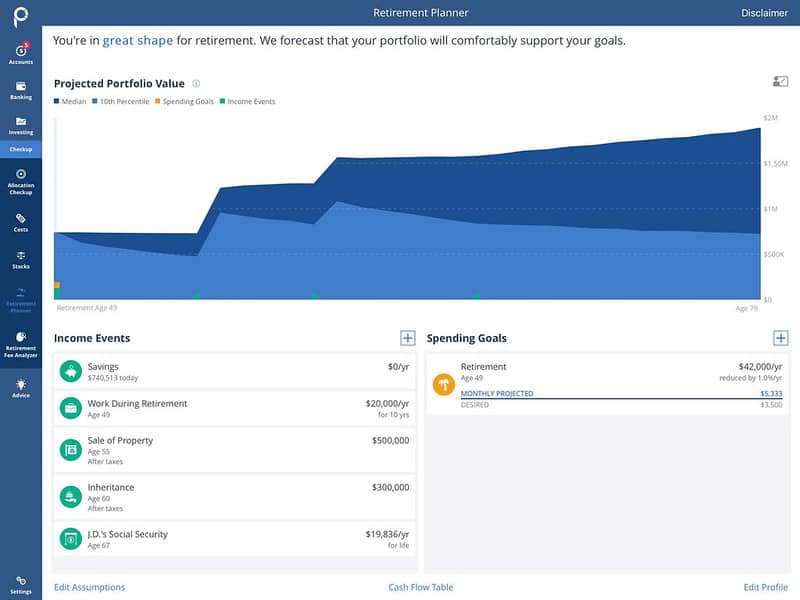

Okay, let's look at the ultimate optimistic scenario. Let's say I trim my spending from $60,000 per year to $42,000 per year. Let's assume I spend the next decade at the box factory earning $20,000 per year. Let's assume that my mother dies in ten years or so and leaves me an inheritance. Let's assume that Kim and I sell this place after increasing frustration with the never-ending repairs, then move into a rented apartment.

After all those assumptions, what does my future look like?

But that's a future that's far too rosy than the one I think lies ahead.

You get the point, though. Even without the app's other features, I'd love Personal Capital just for its retirement calculator. It's more fun and flexible than 95% of the other retirement calculators on the market. (As I mentioned, we'll take a peek at the 5% that are better over the next few days.)

The Bottom Line

I have been using Personal Capital for five years now. It's nowhere near a complete money-management tool, and I know that. But I don't care. I don't expect it to be the biggest and bestest. I accept it for what it is.

Personal Capital is great at a few things:

- Monitoring your money on a daily basis.

- Tracking (and analyzing) your investment portfolio.

- Playing with various retirement scenarios.

If you're not interested in these three tasks, Personal Capital probably isn't right for you. If you want a lot of detail and analysis, Personal Capital probably isn't right for you. If you have a lot of money invested and don't want people to pester you with phone calls, Personal Capital probably isn't right for you.

For everyone else, though, Personal Capital is a useful (if imperfect) tool. If you decide to use it, just be aware of its limitations. As I say, I've been using it for five years. It's not my top tool, but it's the one I access most often. That's worth something, I guess.

I'm curious, though. Many GRS readers must also be using Personal Capital. What are your experiences like? Do you recommend it? What are your favorite features? What do you not like? Would you recommend Personal Capital to a friend?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)

There are 1 comment to "The pros and cons of Personal Capital".

My only gripe with Personal Capital is it only shown 90 days of net worth graph. Why not a year?